As Over 50 Life Insurance Plans Designed for Stability takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Life insurance is a crucial aspect for individuals over 50, providing a sense of security and stability for their future. Let's delve deeper into the intricacies of these specialized plans.

Introduction to Over 50 Life Insurance Plans

Life insurance for individuals over 50 is a crucial financial tool that provides peace of mind and security for both the policyholder and their loved ones. As people in this age group are often nearing retirement or already retired, having a stable life insurance plan becomes even more essential to ensure financial stability and protection in the later years of life.

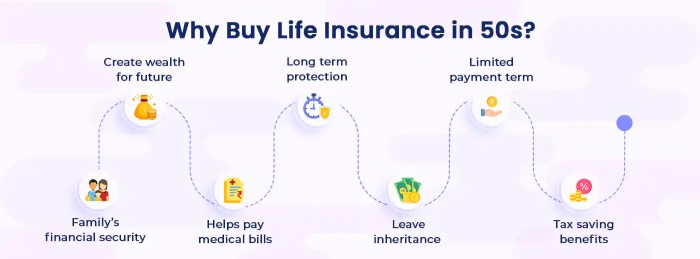

The Importance of Over 50 Life Insurance Plans

Life insurance plans designed for individuals over 50 offer a range of benefits that cater specifically to the needs of this demographic. These plans provide a financial safety net for families, covering expenses such as funeral costs, outstanding debts, and estate taxes.

Moreover, they can help replace lost income and secure the financial future of dependents left behind.

Additionally, over 50 life insurance plans can serve as a means to leave a legacy or inheritance for loved ones, ensuring that they are taken care of even after the policyholder passes away. This financial security can bring peace of mind and alleviate concerns about the future.

Statistics on the Relevance of Life Insurance for Individuals Over 50

According to recent data, a significant number of individuals over 50 are underinsured or lack adequate life insurance coverage. This leaves them vulnerable to financial hardship in case of unexpected events such as illness or premature death. In fact, studies show that a large percentage of people in this age group rely on their savings or retirement funds to cover end-of-life expenses, which may not always be sufficient.

By investing in a stable and comprehensive life insurance plan tailored for individuals over 50, individuals can ensure that their families are protected and financially secure, even in challenging circumstances.

Types of Over 50 Life Insurance Plans

When it comes to life insurance plans for individuals over 50, there are several options available to provide financial stability and peace of mind for the future. Let's explore the different types of life insurance plans in detail.

Term Life Insurance

Term life insurance is a type of policy that provides coverage for a specific period, typically 10, 20, or 30 years. This type of insurance is more affordable compared to whole life insurance, making it a popular choice for individuals over 50 who want coverage for a specific time frame.

The premiums are fixed for the duration of the policy, providing predictability in terms of cost.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. This type of policy offers a cash value component that grows over time, providing a savings element in addition to the death benefit.

While whole life insurance tends to have higher premiums compared to term life insurance, it offers lifelong coverage and the potential for cash value accumulation.

Universal Life Insurance

Universal life insurance is another option for individuals over 50, offering flexibility in premium payments and death benefits. This type of policy allows policyholders to adjust their premiums and death benefits based on their changing needs. Universal life insurance also has a cash value component that can grow over time, providing additional financial security.

Case Study: John's Decision

John, a 55-year-old individual, is considering his life insurance options. After weighing the pros and cons of term life insurance, whole life insurance, and universal life insurance, John decides to opt for whole life insurance. He values the lifelong coverage and cash value accumulation that this type of policy offers, providing him with stability and peace of mind for the future.

Benefits of Over 50 Life Insurance Plans

Investing in a life insurance plan specifically designed for individuals over 50 offers a multitude of advantages. These plans not only provide financial stability and security for the policyholder but also ensure peace of mind for their loved ones.

Financial Protection

- Over 50 life insurance plans offer a guaranteed payout to beneficiaries upon the policyholder's passing, helping cover funeral expenses, outstanding debts, and other financial obligations.

- These plans can act as an income replacement for the family members left behind, ensuring they are financially secure even after the policyholder's death.

Ease of Approval

- Unlike traditional life insurance policies, over 50 life insurance plans usually do not require a medical exam, making them easier to qualify for, especially for individuals with pre-existing health conditions.

- The application process is streamlined, with minimal paperwork and quick approval, allowing individuals to secure coverage without unnecessary delays.

Flexible Premium Options

- These plans often come with flexible premium payment options, allowing policyholders to choose a payment schedule that fits their budget and financial goals.

- Policyholders can also opt for a single premium payment, eliminating the need for ongoing payments and ensuring coverage for the rest of their lives.

Factors to Consider When Choosing a Plan

When selecting an over 50 life insurance plan, there are several key factors that individuals should take into consideration to ensure they choose the most suitable option for their needs.

Coverage Amount

The coverage amount is a crucial factor to consider when choosing a life insurance plan. It is important to assess how much coverage you need to adequately protect your loved ones in the event of your passing. Consider factors such as outstanding debts, funeral expenses, and the financial needs of your dependents when determining the appropriate coverage amount.

Premiums

The premiums for your life insurance plan will impact your budget now and in the future. It is essential to choose a plan with premiums that you can afford to pay consistently. Compare quotes from different insurance providers to find a plan that offers a balance between affordability and adequate coverage.

Policy Terms

The policy terms, including the length of the coverage and any additional benefits or riders, should also be carefully evaluated. Consider whether you need a term life insurance plan that provides coverage for a specific period or a whole life insurance plan that offers lifelong protection.

Review the terms and conditions of the policy to ensure it aligns with your financial goals and objectives.

Choosing the Most Suitable Plan

To evaluate and choose the most suitable over 50 life insurance plan based on your individual needs, consider working with a reputable insurance agent or financial advisor. They can help you assess your financial situation, understand your insurance needs, and compare different options to find a plan that meets your requirements.

Additionally, take the time to read the fine print of the policy, ask questions, and clarify any doubts before making a decision.

Conclusion

In conclusion, Over 50 Life Insurance Plans Designed for Stability offer a reliable financial cushion for individuals in their golden years, ensuring peace of mind and protection for their loved ones. Make an informed decision and secure your future today.

Question & Answer Hub

What are the key benefits of Over 50 Life Insurance Plans?

Over 50 Life Insurance Plans offer stability, financial security, and peace of mind for policyholders and their families.

How do I choose the most suitable plan for me?

Consider factors like coverage amount, premiums, and policy terms to evaluate and select the plan that best fits your individual needs.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)