Delving into the realm of Life Insurance Quotes Explained for Long-Term Financial Security, readers are invited to explore a world where financial stability meets peace of mind, setting the stage for an enlightening journey filled with valuable insights and practical advice.

The following paragraphs will shed light on the nuances of life insurance, unraveling its significance and intricacies for readers seeking to secure their financial future.

Importance of Life Insurance

Life insurance plays a crucial role in ensuring long-term financial security for individuals and their families. It provides a safety net that can offer peace of mind in knowing that loved ones will be financially protected in case of unexpected events.

Protection Against Financial Hardships

- Life insurance can help cover funeral expenses, outstanding debts, and ongoing living costs for dependents.

- It can replace lost income and maintain the standard of living for surviving family members.

Legacy Planning

- Life insurance can be used to leave a financial legacy for future generations or charitable causes.

- It can provide an inheritance that ensures financial stability for heirs.

Peace of Mind

- Knowing that loved ones are financially protected can alleviate stress and anxiety about the future.

- Life insurance can offer a sense of security and stability during uncertain times.

Types of Life Insurance Policies

Life insurance policies come in various forms to cater to different needs and preferences. Two of the most common types are term life insurance and whole life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the policyholder's beneficiaries if the insured passes away during the term. This type of policy is usually more affordable than whole life insurance because it does not accumulate cash value.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured. It also includes a cash value component that grows over time, allowing the policyholder to access funds through loans or withdrawals. While whole life insurance premiums are typically higher than term life insurance, it offers lifelong protection and a savings element.

Universal Life Insurance

Universal life insurance is a flexible policy that combines the benefits of term and whole life insurance. Policyholders can adjust their premiums and death benefits throughout the policy term, providing more control over their coverage. Additionally, universal life insurance allows for the accumulation of cash value, which can be used to pay premiums or increase the death benefit.Overall, choosing the right life insurance policy depends on your individual needs, financial goals, and risk tolerance.

It's essential to weigh the benefits and features of each type of policy before making a decision to ensure long-term financial security for yourself and your loved ones.

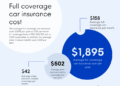

Factors Affecting Life Insurance Quotes

When seeking life insurance quotes, it is essential to understand the key factors that influence the premiums you will pay. Factors such as age, health, lifestyle, and coverage amount play a crucial role in determining how much you will pay for your life insurance policy.

Age

Age is a significant factor that affects life insurance quotes. Generally, the younger you are when you purchase a life insurance policy, the lower your premiums will be. This is because younger individuals are considered lower risk compared to older individuals.

Health

Your health status also plays a vital role in determining your life insurance quotes. Insurance companies assess your health through medical examinations and your medical history. Individuals with pre-existing medical conditions or unhealthy lifestyles may face higher premiums due to the increased risk of early mortality.

Lifestyle

Your lifestyle choices, such as smoking, drinking, or engaging in high-risk activities, can impact your life insurance quotes. Insurers consider these factors when assessing your risk profile. Individuals with risky lifestyle habits may face higher premiums compared to those leading a healthier lifestyle.

Coverage Amount

The coverage amount you choose for your life insurance policy also influences the quotes you receive. Higher coverage amounts typically result in higher premiums. It is essential to strike a balance between the coverage you need and the premiums you can afford

By being aware of how age, health, lifestyle, and coverage amount affect your premiums, you can make informed decisions to secure the right coverage for your long-term financial security.

How to Obtain Life Insurance Quotes

Obtaining life insurance quotes is an essential step in securing the right coverage for your financial needs. Here is a step-by-step guide on how to get life insurance quotes:

Step 1: Assess Your Needs

- Calculate your financial obligations, such as mortgage, debts, and future expenses.

- Determine the amount of coverage you need based on your financial situation and family's needs.

Step 2: Research Insurance Providers

- Look for reputable insurance companies that offer life insurance policies.

- Check customer reviews and ratings to ensure the company's reliability.

Step 3: Request Quotes

- Contact insurance providers or use online tools to request life insurance quotes.

- Provide accurate information about your age, health, lifestyle, and coverage needs.

Step 4: Compare Quotes

- Review the quotes received from different insurance providers.

- Compare the coverage amount, premiums, and policy terms to find the best option.

Step 5: Choose the Right Policy

- Consider the financial strength of the insurance company.

- Choose a policy that meets your coverage needs and fits your budget.

Benefits of Long-Term Financial Security

Life insurance plays a crucial role in providing long-term financial security to individuals and their families. Here are some key benefits of having life insurance for long-term financial stability:

Financial Goal Achievement

Life insurance can help individuals achieve their financial goals by providing a lump sum payout to beneficiaries upon the policyholder's death. This payout can be used to cover expenses such as mortgage payments, children's education, or retirement savings, ensuring that loved ones are financially secure even in the policyholder's absence.

Future Planning

Life insurance allows individuals to plan for the future by creating a financial safety net for their loved ones. In the event of an unexpected death, life insurance can provide beneficiaries with the funds needed to maintain their standard of living, pay off debts, or cover estate taxes, ensuring that their financial future is secure.

Financial Safety Net

Life insurance acts as a financial safety net for unexpected situations such as critical illness or disability. Some life insurance policies offer additional benefits like critical illness coverage or disability income, providing policyholders with financial support during challenging times and ensuring that they can maintain their quality of life despite unforeseen circumstances.

Last Recap

In conclusion, Life Insurance Quotes Explained for Long-Term Financial Security serves as a beacon of financial wisdom, guiding individuals towards a path of stability and preparedness. As the discussion comes to a close, it leaves behind a trail of knowledge and empowerment, urging readers to take proactive steps towards safeguarding their financial well-being.

Expert Answers

What factors influence life insurance quotes?

Age, health, lifestyle, and coverage amount are key factors that impact insurance premiums.

How can life insurance provide long-term financial security?

Life insurance acts as a financial safety net, helping individuals achieve financial goals and plan for the future.

What types of life insurance policies are available?

There are various types such as term life, whole life, and universal life insurance policies.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)