Commercial Auto Insurance Basics for Small and Medium Businesses sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the intricacies of commercial auto insurance, we uncover a world where protection and preparedness are paramount for businesses of all sizes.

Overview of Commercial Auto Insurance for Small and Medium Businesses

When it comes to operating a business that uses vehicles for its operations, having commercial auto insurance is crucial. This type of insurance provides coverage specifically tailored to protect businesses from financial losses resulting from accidents or damage involving company vehicles.

Importance of Commercial Auto Insurance

- Commercial auto insurance helps protect businesses from liabilities in case of accidents involving company vehicles.

- It provides coverage for physical damage to the vehicles themselves, ensuring that the business can recover quickly without facing significant financial losses.

- Having commercial auto insurance can also help maintain the business's reputation by demonstrating responsibility and commitment to safety.

Scenarios Where Commercial Auto Insurance is Necessary

- Delivery services: Businesses that rely on delivering goods or services using company vehicles need commercial auto insurance to protect their assets.

- Construction companies: With heavy machinery and vehicles involved in construction projects, having the right insurance coverage is essential to mitigate risks.

- Transportation services: Companies offering transportation services for passengers or goods must have commercial auto insurance to protect against potential accidents.

Key Differences Between Commercial Auto Insurance and Personal Auto Insurance

- Usage: Commercial auto insurance covers vehicles used for business purposes, while personal auto insurance is for personal use vehicles.

- Coverage limits: Commercial auto insurance typically offers higher coverage limits to account for the increased risks associated with business operations.

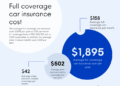

- Premiums: The cost of commercial auto insurance is generally higher than personal auto insurance due to the higher coverage limits and risks involved in business operations.

Types of Coverage

Commercial auto insurance offers various types of coverage options to protect businesses from financial losses in case of accidents or other incidents involving company vehicles. Understanding these coverage options is essential for small and medium businesses to make informed decisions when selecting the right policy.

Liability Coverage

Liability coverage is a fundamental component of commercial auto insurance as it helps protect businesses from financial responsibility for damages or injuries caused to others in an accident where the insured driver is at fault. This coverage typically includes bodily injury liability and property damage liability, providing compensation for medical expenses, lost wages, and property repairs.

Comprehensive Coverage vs. Collision Coverage

Both comprehensive coverage and collision coverage are additional options that businesses can consider to enhance their insurance protection.

- Comprehensive Coverage:This type of coverage helps pay for damages to the insured vehicle that result from non-collision events, such as theft, vandalism, fire, or natural disasters. It provides comprehensive protection for a wide range of risks beyond accidents.

- Collision Coverage:Collision coverage, on the other hand, specifically covers damages to the insured vehicle resulting from a collision with another vehicle or object. This coverage is essential for repairing or replacing the company vehicle after an accident.

Factors Influencing Premiums

When it comes to commercial auto insurance for small and medium businesses, there are several key factors that insurance companies take into account when determining premiums. Understanding these factors can help business owners make informed decisions to manage their insurance costs effectively.

Type of Business

The nature of the business plays a significant role in determining insurance premiums. Some industries may have higher risks associated with their operations, leading to higher insurance costs. For example, a construction company with heavy-duty vehicles may face higher premiums compared to a consulting firm with a few sedans.

Number of Vehicles

The number of vehicles in a business's fleet directly impacts insurance rates. Generally, the more vehicles there are to insure, the higher the premiums will be. Businesses with a larger fleet may benefit from bulk discounts, but they will still pay more overall compared to those with fewer vehicles.

Driving Records

The driving records of employees who operate company vehicles can also influence insurance premiums. Businesses with drivers who have clean records and minimal accidents may qualify for lower rates. On the other hand, a history of accidents or traffic violations among employees can lead to higher premiums.

Impact of Deductibles

Choosing higher deductibles can have a significant impact on premium rates. A deductible is the amount a business must pay out of pocket before the insurance coverage kicks in. Opting for higher deductibles can lower monthly premiums, but it also means that the business will have to cover more of the costs in the event of a claim.

It's essential to strike a balance between a manageable deductible and affordable premiums.

Legal Requirements and Regulations

Commercial auto insurance is not just a recommendation; it's a legal requirement for businesses operating vehicles. Failure to comply with these regulations can lead to severe consequences, including fines, penalties, and even legal action.

State and Federal Legal Requirements

When it comes to commercial auto insurance, businesses must adhere to both state and federal regulations

- State requirements can vary widely, so it's crucial for businesses to understand and comply with the specific rules in their operating state.

- Failing to meet these legal requirements can result in fines, license suspension, or even the closure of the business.

Consequences of Inadequate Insurance Coverage

Not having adequate insurance coverage for business vehicles can have serious repercussions. In the event of an accident or damage involving an uninsured or underinsured vehicle, businesses may face:

- Financial liabilities that could bankrupt the business

- Lawsuits from injured parties seeking compensation

- Loss of reputation and trust among customers and partners

Examples of Legal Cases

There have been numerous legal cases where businesses faced severe consequences due to inadequate insurance coverage for their commercial vehicles. One such example is the case of XYZ Company, which was sued for millions of dollars after a delivery truck caused a major accident resulting in multiple injuries and property damage.

The lack of proper insurance coverage left the company exposed to significant financial losses and legal liabilities.

Claims Process and Documentation

When it comes to commercial auto insurance, understanding the claims process and having the right documentation in place is crucial for small and medium businesses. This ensures a smooth and efficient handling of claims in case of an accident or damage to vehicles.

Typical Claims Process

After an incident occurs, the first step is to notify your insurance provider as soon as possible. They will guide you through the next steps and may require you to provide certain documentation.

Next, an adjuster will be assigned to assess the damage and determine the coverage under your policy. They will investigate the claim and work with you to reach a settlement.

Once the claim is approved, the insurance company will provide compensation according to the terms of your policy.

Essential Documentation Checklist

1. Accident report or incident details

2. Photos of the damage or accident scene

3. Witness statements, if available

4. Vehicle registration and insurance information

5. Driver's license and contact information

6. Repair estimates and invoices

Expedite Claims Process and Maximize Benefits

1. Report the claim promptly to your insurance provider to avoid delays.

2. Keep all documentation organized and readily accessible for easy submission.

3. Cooperate fully with the adjuster and provide any additional information they request.

4. Review your policy to understand the coverage and ensure you are maximizing your benefits.

5. Consider working with a trusted insurance agent to help navigate the claims process effectively.

End of Discussion

In conclusion, understanding the fundamentals of commercial auto insurance is crucial for the smooth operation of small and medium businesses. By grasping the nuances of coverage options, influencing factors on premiums, legal requirements, and the claims process, businesses can navigate the road ahead with confidence and security.

Q&A

What types of coverage are available for commercial auto insurance?

Commercial auto insurance typically includes liability coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage.

How do driving records impact insurance costs for businesses?

A clean driving record can lead to lower premiums, while a history of accidents or violations may result in higher insurance costs.

What are the legal consequences of not having adequate insurance coverage for business vehicles?

Operating vehicles without sufficient insurance can lead to fines, legal penalties, and potential lawsuits in case of accidents.

How can businesses expedite the claims process for commercial auto insurance?

Businesses can speed up the claims process by promptly reporting incidents, providing all necessary documentation, and cooperating with insurance adjusters.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)