Cheap Full Coverage Car Insurance Without Hidden Fees sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on transparency and affordability. As car insurance is a crucial aspect of vehicle ownership, understanding how to secure full coverage without hidden fees is essential for peace of mind on the road.

Overview of Cheap Full Coverage Car Insurance

When it comes to car insurance, full coverage provides a higher level of protection compared to basic coverage options. It includes comprehensive and collision coverage in addition to the state-required liability coverage.

Benefits of Full Coverage

- Protection for your vehicle in case of accidents, theft, or damage not caused by a collision.

- Potentially lower out-of-pocket expenses for repairs or replacements.

- Peace of mind knowing you have comprehensive coverage for various scenarios.

Components of Full Coverage Car Insurance

Full coverage car insurance typically includes the following components:

- Liability Coverage: Covers damages and injuries you cause to others in an at-fault accident.

- Collision Coverage: Pays for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover costs if you're in an accident with a driver who has insufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of fault.

Factors Affecting Full Coverage Car Insurance Costs

When it comes to determining the cost of full coverage car insurance, several factors come into play. These factors can vary from the type of car you drive to personal details like age and driving record. Understanding these key elements can help you make informed decisions when shopping for car insurance.

Type of Car

The type of car you drive can significantly impact the cost of your full coverage car insurance. Insurance companies consider factors such as the make, model, year, and safety features of your vehicle when calculating your premium. Generally, newer and more expensive cars will have higher insurance rates due to the cost of repairs or replacement.

Personal Factors

Personal details such as age, gender, and driving record also play a crucial role in determining insurance costs. Younger drivers, especially teenagers, typically face higher premiums due to their lack of experience on the road. Additionally, male drivers tend to pay more for insurance compared to female drivers.

A clean driving record with no accidents or traffic violations can help lower your insurance rates.

Location and Driving Habits

Where you live and how you drive can impact the price of your full coverage car insurance. Urban areas with higher rates of accidents and theft may result in higher premiums. Similarly, if you have a long commute or frequently drive during peak hours, you may face increased insurance costs.

Safe driving habits, such as maintaining a clean record and taking defensive driving courses, can help mitigate these factors and potentially lower your insurance rates.

Shopping for Affordable Full Coverage Car Insurance

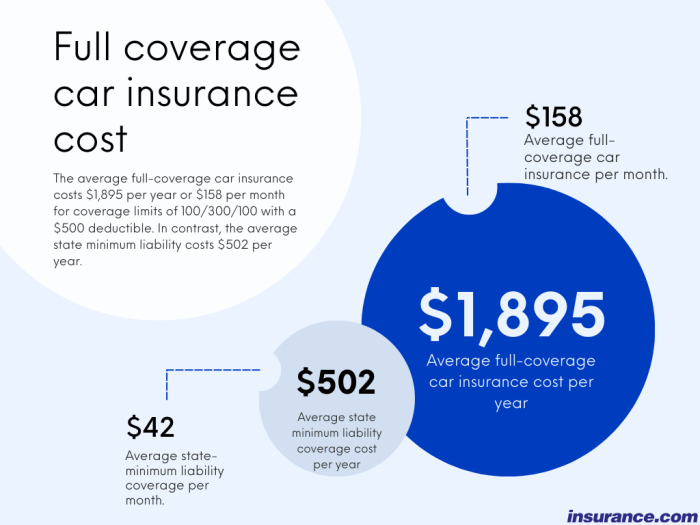

When looking for affordable full coverage car insurance, it is important to compare quotes from different insurance companies to find the best deal that fits your budget and coverage needs.It is crucial to consider coverage limits and deductibles when searching for cheap full coverage car insurance.

While opting for lower coverage limits and higher deductibles can lower your premium costs, it is essential to make sure you have enough coverage to protect yourself financially in case of an accident.

Comparing Quotes from Different Insurance Companies

When comparing quotes from different insurance companies, make sure to provide the same information and coverage limits to get an accurate comparison

- Request quotes online or through an insurance agent to compare prices easily.

- Check customer reviews and ratings to ensure the company has a good reputation for customer service and claims handling.

- Consider the financial stability of the insurance company to make sure they can pay out claims when needed.

Bundling Policies and Qualifying for Discounts

Bundling policies, such as combining your car insurance with home or renters insurance, can often lead to significant discounts on your premiums. Additionally, many insurance companies offer discounts for safe driving records, taking defensive driving courses, or having anti-theft devices installed in your vehicle.

By bundling policies or qualifying for discounts, you can potentially save money on your full coverage car insurance premiums.

Hidden Fees to Watch Out for in Full Coverage Car Insurance

When purchasing full coverage car insurance, it's essential to be aware of potential hidden fees that insurance companies may include in their policies. These fees can significantly impact the overall cost of your insurance coverage, so it's crucial to carefully read the fine print to uncover any additional charges that may not be immediately obvious.

Common Hidden Fees in Full Coverage Car Insurance

- Administrative Fees: Some insurance companies may charge administrative fees for policy processing and maintenance.

- Policy Change Fees: Making changes to your policy, such as adding or removing drivers or vehicles, may incur additional fees.

- Payment Processing Fees: Some insurers charge fees for specific payment methods or installment plans.

Significance of Reading the Fine Print

Reading the fine print of your insurance policy is crucial to uncover any hidden fees that could increase the overall cost of your coverage. By understanding the terms and conditions of your policy, you can avoid any surprises when it comes time to file a claim or make changes to your coverage.

Examples of Additional Fees

-

Roadside Assistance Fees: Some insurers may charge an additional fee for including roadside assistance in your policy.

-

Underwriting Fees: These fees cover the cost of assessing your risk as a driver and determining your premium.

-

Cancellation Fees: Cancelling your policy before the end of the term may result in fees imposed by the insurance company.

Epilogue

In conclusion, navigating the landscape of full coverage car insurance without hidden fees can be a daunting task, but armed with the right knowledge and tools, it becomes a manageable and rewarding experience. With a clear understanding of what to look for and how to compare options, finding affordable full coverage car insurance is within reach for every driver.

Essential FAQs

What does full coverage car insurance include?

Full coverage car insurance typically includes liability, collision, and comprehensive coverage to protect you and your vehicle in various situations.

How can I reduce the cost of full coverage car insurance?

You can reduce costs by comparing quotes, adjusting coverage limits and deductibles, bundling policies, and qualifying for discounts based on your driving record or other factors.

What are common hidden fees in full coverage car insurance?

Common hidden fees may include processing fees, administrative charges, or additional fees for specific coverage options. It's crucial to review the policy details carefully to uncover any hidden costs.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)