Homeowners Insurance Quote Tips for High-Value Properties sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

This topic delves into the essential aspects of homeowners insurance for high-value properties, shedding light on the importance of adequate coverage and the factors that influence insurance quotes.

Importance of Homeowners Insurance for High-Value Properties

Owning a high-value property comes with a unique set of risks that necessitate having adequate homeowners insurance coverage.

Risks Associated with High-Value Properties

- Increased likelihood of theft or burglary due to valuable assets

- Higher repair or replacement costs for luxury features or materials

- Greater susceptibility to natural disasters or extreme weather events

Financial Implications of Inadequate Insurance Coverage

Not having sufficient homeowners insurance for a high-value property can lead to significant financial strain in the event of unforeseen circumstances.

- Out-of-pocket expenses for costly repairs or replacements

- Lack of coverage for full property value in case of total loss

- Potential legal liabilities if someone is injured on the property

Factors Influencing Insurance Quotes for High-Value Properties

When it comes to insuring high-value properties, there are several factors that can influence the insurance quotes you receive. From the value of the property itself to its location and construction materials, each aspect plays a role in determining the premiums you will pay.

Let's delve into the key factors affecting insurance quotes for high-value properties.

Property Value and Insurance Premiums

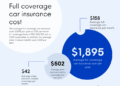

The value of your property is a crucial factor that directly impacts the insurance premiums you will be quoted. High-value properties typically require higher coverage limits, which in turn lead to higher premiums. Insurers consider the replacement cost of the property when calculating the premium, so the more valuable your property, the more you can expect to pay for insurance.

Location, Construction Materials, and Additional Features

The location of your high-value property also plays a significant role in determining insurance quotes. Properties in areas prone to natural disasters or high crime rates may attract higher premiums due to increased risk. Similarly, the construction materials used and additional features such as swimming pools, guest houses, or home theaters can impact insurance costs.

Insurers assess the risk associated with these factors and adjust the premiums accordingly.

Comparison with Standard Properties

When comparing insurance quotes for high-value properties versus standard properties, the differences are evident. High-value properties often require specialized coverage and higher limits to adequately protect the substantial investment. This, in turn, leads to higher premiums compared to standard properties.

Insurers take into account the unique risks and replacement costs associated with high-value properties, resulting in a disparity in insurance quotes between the two.

Tips for Obtaining Accurate Insurance Quotes

When it comes to insuring high-value properties, obtaining accurate insurance quotes is crucial to ensure adequate coverage. Here are some tips to help you navigate this process effectively.

Estimating Property Value

- Engage the services of a professional appraiser or valuator to assess the value of your property accurately.

- Consider factors such as location, size, construction quality, and unique features when determining the value of your property.

- Regularly update the valuation of your property to reflect any changes or improvements made over time.

Including Valuable Items

- Take inventory of all valuable items within your property, including jewelry, art pieces, electronics, and other high-worth possessions.

- Keep detailed records, such as receipts, appraisals, and photographs, to prove the existence and value of these items to your insurance provider.

- Consider adding a rider or endorsement to your policy to specifically cover high-value items that may exceed standard coverage limits.

Negotiating with Insurance Providers

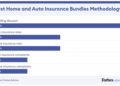

- Shop around and compare quotes from multiple insurance providers to find the best coverage options at competitive rates.

- Consider bundling your homeowners insurance with other policies, such as auto or umbrella insurance, to potentially qualify for discounts.

- Be proactive in discussing your needs and preferences with insurance agents, and don't hesitate to negotiate for better terms or rates based on your property's unique characteristics.

Customizing Coverage for High-Value Properties

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource] High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1.jpg)

When it comes to high-value properties, standard homeowners insurance may not provide adequate coverage due to the unique risks and expensive assets involved. Customizing insurance coverage for high-value properties is crucial to ensure comprehensive protection against potential risks.

Types of Additional Coverage Options

For high-value properties, there are several additional coverage options available to tailor the insurance policy according to specific needs and vulnerabilities. These options include:

- Extended Replacement Cost Coverage: Provides coverage beyond the policy limit to rebuild or repair the home to its original condition, even if costs exceed the coverage limit.

- Jewelry and Valuable Items Coverage: Offers higher coverage limits for valuable items like jewelry, art, antiques, and collectibles that may not be fully covered under a standard policy.

- Identity Theft Protection: Safeguards against identity theft and covers expenses related to restoring your identity in case of fraudulent activities.

- Ordinance or Law Coverage: Covers additional costs associated with rebuilding or repairing a home to comply with current building codes or regulations.

Scenarios Benefiting from Customized Coverage

Customized coverage for high-value properties can be highly beneficial in various scenarios, such as:

- High-Value Art Collection:In the event of theft, damage, or loss of valuable art pieces, specialized coverage can ensure adequate compensation for their full value.

- Luxury Home Features:Custom features like smart home technology, high-end appliances, or custom-built structures may require additional coverage to cover repair or replacement costs.

- High-Value Jewelry:Standard policies often have limits on jewelry coverage, while customized coverage can provide higher limits and coverage for lost or stolen pieces.

- Unique Risks:High-value properties may face unique risks such as expensive landscaping, wine collections, or high-end electronics, which can be adequately covered with customized insurance options.

Ultimate Conclusion

In conclusion, navigating the world of homeowners insurance for high-value properties requires careful consideration and attention to detail. By customizing coverage, obtaining accurate quotes, and understanding the risks involved, homeowners can protect their valuable investments effectively.

Helpful Answers

What are the risks associated with owning a high-value property?

Owning a high-value property can increase the likelihood of theft, property damage, and potential liability claims, making adequate insurance coverage crucial.

How can I accurately estimate the value of my high-value property for insurance purposes?

Hiring a professional appraiser or using recent sale prices of similar properties in the area can help in accurately estimating the value of a high-value property.

What are some examples of scenarios where customized coverage for high-value properties would be beneficial?

Customized coverage would be beneficial in cases of expensive art collections, jewelry, or unique architectural features that require specific insurance protection beyond standard policies.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-700x375.jpg)

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)