As Business Insurance for LLC Owners: What Coverage Do You Really Need takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Exploring the ins and outs of business insurance for LLC owners is crucial in safeguarding your company's future. Understanding the necessary coverage can mean the difference between success and financial turmoil.

Types of Business Insurance for LLC Owners

When it comes to protecting your LLC, having the right insurance coverage is crucial. Here are some of the key types of business insurance that LLC owners should consider:

Liability Insurance for LLCs

Liability insurance is essential for LLCs as it helps protect the business from financial losses resulting from lawsuits. This type of insurance typically covers legal fees, settlements, and judgments in case the business is sued for things like bodily injury, property damage, or advertising injury.

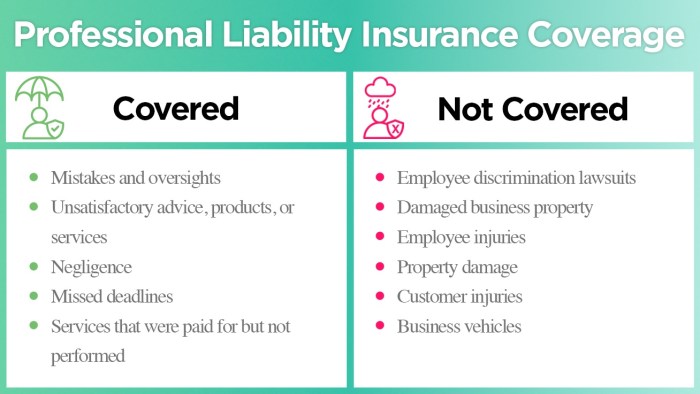

General Liability Insurance vs. Professional Liability Insurance

General liability insurance and professional liability insurance are both important for LLC owners, but they cover different types of risks. General liability insurance protects against claims of bodily injury or property damage, while professional liability insurance (also known as errors and omissions insurance) covers claims of professional negligence or failure to perform services.

Property Insurance for LLCs

Property insurance is necessary for LLCs that own or lease commercial property, equipment, or inventory. This type of insurance helps cover the cost of repairing or replacing property that is damaged or stolen due to covered perils like fire, theft, or vandalism.Overall, having the right mix of insurance coverage can help protect your LLC from unexpected events and potential financial losses.

Make sure to assess your business's needs and consult with an insurance professional to determine the best coverage options for your specific situation.

Determining Coverage Needs

Determining the appropriate insurance coverage for an LLC involves considering various factors that can impact the type and amount of coverage needed. Assessing risks, understanding the size and nature of the business, and taking into account the location of the business are crucial steps in determining coverage needs.

Factors Influencing Coverage Needs

- Assessing Risks: Conduct a thorough risk assessment to identify potential threats to your business, such as property damage, liability claims, or employee injuries. Understanding these risks will help you determine the types of insurance coverage required.

- Size and Nature of the Business: The size and nature of your business will also influence the type of insurance needed. For example, a small LLC with fewer employees may require different coverage compared to a larger corporation with multiple locations.

- Location of the Business: The location of your business can impact insurance needs due to factors like local regulations, weather risks, crime rates, and proximity to natural disasters. It's essential to consider these location-specific factors when selecting insurance coverage.

Bundling Insurance Policies

When it comes to protecting your LLC, bundling insurance policies can offer several advantages. Not only does it provide convenience by consolidating multiple policies into one package, but it can also result in cost savings and a more comprehensive coverage plan tailored to your specific business needs.

Advantages of Bundling

- Cost Savings: Bundling different insurance policies such as general liability, property, and commercial auto can often lead to discounted rates from insurers.

- Simplified Management: Managing one bundled insurance policy is much easier than keeping track of multiple individual policies, saving you time and hassle.

- Comprehensive Coverage: Bundling allows you to customize a package that covers all aspects of your business, ensuring you have the protection you need.

Common Insurance Bundles

- Business Owner's Policy (BOP): Combines general liability and property insurance, typically at a lower cost than purchasing separate policies.

- Commercial Package: Includes a mix of coverages such as property, liability, and business interruption insurance, tailored to your industry.

- Professional Liability Bundle: Combines errors and omissions insurance with general liability, offering protection against professional mistakes and lawsuits.

Cost Savings for LLC Owners

- Discounted Rates: Insurers often provide discounts for bundling policies, resulting in overall lower premiums for the bundled coverage.

- Reduced Fees: Bundling can also lead to reduced administrative fees and processing costs, saving you money in the long run.

- Increased Value: By bundling, you can get more coverage for your money, ensuring your LLC is adequately protected without breaking the bank.

Customizing Bundled Insurance Packages

- Assessment: Work with an insurance agent to assess your business risks and determine the types of coverage you need in your bundled package.

- Tailoring: Customize the bundled package to include specific coverages relevant to your industry, such as cyber liability or professional indemnity insurance.

- Review: Regularly review your bundled insurance policies to ensure they still meet your business needs and make adjustments as necessary.

Understanding Workers' Compensation Insurance

Workers' compensation insurance is crucial for LLCs with employees as it provides financial protection in case an employee gets injured or becomes ill due to work-related activities. This type of insurance helps cover medical expenses, lost wages, and rehabilitation costs for the employee.

Importance of Workers' Compensation Insurance

- Ensures compliance with legal requirements: Providing workers' compensation coverage is mandatory in most states for businesses with employees. Failing to have this insurance can result in penalties, fines, and even legal action.

- Protects employees: Workers' compensation insurance ensures that employees receive the necessary medical care and financial support if they are injured on the job. It helps them recover and return to work as soon as possible.

- Protects business owners: By having workers' compensation insurance, business owners can avoid facing costly lawsuits and claims for workplace injuries. It provides financial protection and peace of mind.

Benefits of Workers' Compensation Insurance

- Medical coverage: Workers' compensation insurance covers medical expenses related to work injuries, including doctor visits, surgeries, medications, and rehabilitation.

- Lost wages: If an employee is unable to work due to a work-related injury, workers' compensation insurance provides partial replacement of lost wages until they can return to work.

- Legal protection: Having workers' compensation insurance can protect business owners from lawsuits and legal claims related to workplace injuries. It helps cover legal expenses and settlements.

Examples of Crucial Situations

- Construction site accidents: In industries like construction where the risk of injuries is high, workers' compensation insurance is crucial to cover medical expenses and lost wages for injured workers.

- Repetitive strain injuries: Employees who develop repetitive strain injuries due to their job tasks, such as carpal tunnel syndrome, can benefit from workers' compensation insurance to cover medical treatments and rehabilitation.

- Slip and fall accidents: If an employee slips and falls at the workplace, resulting in injuries, workers' compensation insurance can help cover medical costs and provide financial support during recovery.

Closing Summary

In conclusion, navigating the waters of business insurance for LLC owners requires careful consideration and informed decision-making. By ensuring you have the right coverage tailored to your specific needs, you can protect your business from unforeseen challenges and thrive in a competitive landscape.

FAQ

What factors influence the type and amount of insurance coverage needed for an LLC?

Factors such as industry risks, business size, and location play a significant role in determining the coverage needs for an LLC. Conducting a thorough risk assessment can help in identifying the appropriate coverage levels.

Why is workers' compensation insurance important for LLCs with employees?

Workers' compensation insurance is crucial as it provides financial protection for both employees and business owners in case of work-related injuries or illnesses. It also helps in complying with legal requirements.

How can bundling insurance policies benefit LLC owners?

Bundling insurance policies can offer cost savings, streamlined management, and comprehensive coverage for different aspects of the business. It simplifies the insurance process and ensures adequate protection.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-75x75.jpg)

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)