Embark on a journey through the realm of Homeowners Insurance Quote Guide for First-Time Buyers, where you will discover essential insights and valuable information tailored for those stepping into the realm of home ownership for the first time. Prepare to be enlightened and empowered as we delve into the intricacies of securing the right insurance coverage for your new abode.

In the subsequent section, we will delve deeper into the nuances of homeowners insurance, shedding light on its significance and relevance in the context of first-time homebuyers.

Understanding Homeowners Insurance

Homeowners insurance is a crucial financial safety net that protects your home, belongings, and liability in case of unforeseen events.

Purpose of Homeowners Insurance

- Property Coverage: Protects your home and other structures on your property from damage or destruction caused by covered perils like fire, theft, or vandalism.

- Personal Property Coverage: Covers your belongings inside the home, such as furniture, electronics, and clothing.

- Liability Coverage: Offers protection if someone is injured on your property and you are found legally responsible.

Comparison to Other Property Insurance

Unlike renters insurance, homeowners insurance covers the physical structure of your home. It also differs from mortgage insurance, which protects the lender in case you default on your mortgage.

Examples of Protection Offered

- If a fire damages your home, homeowners insurance can help cover the cost of repairs or rebuilding.

- In case a visitor slips and falls on your property, liability coverage can assist with medical bills and legal expenses.

- If your personal belongings are stolen during a break-in, personal property coverage can help replace them.

Importance of Homeowners Insurance for First-Time Buyers

Homeowners insurance is a crucial aspect of purchasing your first home, providing financial protection and peace of mind in unforeseen circumstances.

Why Homeowners Insurance is Essential for First-Time Homebuyers

Having homeowners insurance is essential for first-time buyers as it protects their investment in the property. In the event of damage or loss due to natural disasters, theft, or accidents, insurance coverage can help cover repair costs or even rebuild the home.

How Homeowners Insurance Safeguards First-Time Buyers' Investment

- Homeowners insurance provides financial protection against unexpected events that could otherwise result in significant financial loss.

- It covers not only the structure of the home but also personal belongings inside, providing comprehensive coverage for first-time buyers.

- Insurance can also offer liability protection in case someone is injured on the property, safeguarding homeowners from legal and medical expenses.

Tips on Selecting the Right Coverage for First-Time Buyers

- Assess the value of your home and belongings to determine the appropriate coverage amount.

- Consider additional coverage options such as flood insurance or earthquake insurance, depending on your location and risk factors.

- Compare quotes from multiple insurance providers to find the best coverage at a competitive price.

Common Misconceptions First-Time Buyers May Have About Homeowners Insurance

- One common misconception is that homeowners insurance covers all types of damage, which may not always be the case. It's important to understand the specific coverage included in your policy.

- Some first-time buyers may underestimate the value of their personal belongings, leading to inadequate coverage in case of loss or damage.

- Another misconception is that homeowners insurance is optional, when in reality, most mortgage lenders require it as part of the loan agreement.

Factors Influencing Homeowners Insurance Quotes

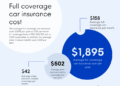

When it comes to determining homeowners insurance quotes, several key factors come into play. These factors can significantly impact the cost of your insurance premiums. Let's delve into the main aspects that influence homeowners insurance quotes.

Location of the Property

The location of your property plays a crucial role in determining your homeowners insurance premiums. Properties located in regions prone to natural disasters such as hurricanes, earthquakes, or floods are considered high-risk areas. As a result, insurance companies may charge higher premiums for properties in these locations to account for the increased risk of potential damage or loss.

Home Value, Construction Materials, and Age

The value of your home, the materials used in its construction, and the age of the property are also significant factors that influence insurance costs. A more valuable home typically requires higher coverage limits, leading to higher premiums. Similarly, homes built with more durable materials may have lower insurance costs compared to those constructed with materials prone to damage

The age of your home can also impact insurance rates, as older homes may have outdated systems that pose a higher risk of issues or failures.

Personal Factors: Credit Score and Claims History

Personal factors such as your credit score and claims history can also affect homeowners insurance quotes. Insurance companies often consider your credit score when determining your premium, as a higher credit score is typically associated with lower risk. Additionally, your claims history, including the frequency and severity of past claims, can impact the cost of your insurance.

A history of frequent claims may result in higher premiums, as it suggests a higher likelihood of future claims.

Obtaining Homeowners Insurance Quotes

When looking to purchase homeowners insurance, it is essential to gather quotes from different insurance providers to compare coverage options and pricing. Obtaining homeowners insurance quotes is a crucial step in finding the right policy for your needs and budget.

Comparing Benefits of Multiple Quotes

- By obtaining quotes from multiple insurance providers, you can compare coverage options, pricing, and discounts offered by each company.

- Comparing quotes allows you to find the best value for your money and ensure that you are getting adequate coverage for your home.

- Different insurance companies may offer unique benefits or discounts, so exploring multiple quotes can help you find the best deal.

Reviewing Coverage Limits and Deductibles

- When reviewing homeowners insurance quotes, pay close attention to the coverage limits and deductibles Artikeld in each policy.

- Ensure that the coverage limits are sufficient to protect your home, belongings, and assets in case of a covered loss.

- Consider how the deductibles will affect your out-of-pocket expenses in the event of a claim and choose a policy with deductibles that align with your budget.

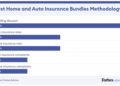

Understanding and Comparing Quotes

- Take the time to understand the terms and coverage details in each homeowners insurance quote to make an informed decision.

- Compare the premiums, coverage limits, deductibles, and any additional features or endorsements included in each quote.

- Consider factors like customer reviews, the financial strength of the insurance company, and the ease of filing claims when comparing quotes.

Customizing Homeowners Insurance Coverage

When it comes to homeowners insurance, one size does not fit all. Customizing your coverage based on your individual needs is crucial to ensure you are adequately protected. Let's explore the various options available to tailor your policy to specific requirements.

Additional Coverage Options

- Flood Insurance:Standard homeowners insurance policies typically do not cover flood damage. Adding a separate flood insurance policy can provide crucial protection in case of flooding events.

- Personal Property Endorsements:If you have valuable items such as jewelry, art, or electronics, consider adding endorsements to your policy to ensure these items are adequately covered in case of loss or damage.

- Liability Protection:Increasing your liability coverage can protect you in the event someone is injured on your property and decides to sue. This additional coverage can help cover legal expenses and settlement costs.

Situations Where Additional Coverage is Beneficial

- If you live in a flood-prone area, investing in flood insurance is a smart choice to protect your home and belongings.

- For homeowners with high-value personal property, adding endorsements to your policy can provide peace of mind knowing your valuable items are adequately covered.

- Increasing liability protection is especially important for homeowners with high net worth, as they may be more at risk of lawsuits seeking substantial damages.

Tips for Evaluating Coverage Options

- Assess your individual needs and risks to determine which additional coverage options are most relevant to you.

- Review your current policy to identify any coverage gaps that may need to be addressed with additional endorsements or policies.

- Compare quotes from multiple insurance providers to ensure you are getting the best coverage at a competitive price.

Closure

As we draw to a close, reflect on the wealth of knowledge you've gained regarding homeowners insurance for first-time buyers. From understanding the various coverage options to navigating the process of obtaining quotes, this guide equips you with the necessary tools to make informed decisions and protect your newfound investment.

Clarifying Questions

What are the key factors that influence homeowners insurance quotes?

Factors such as the location of the property, home value, construction materials, age of the home, credit score, and claims history can all impact homeowners insurance quotes.

Why is homeowners insurance important for first-time buyers?

Homeowners insurance is crucial for first-time buyers as it protects their investment in the property and provides financial security in case of unforeseen events.

How can first-time buyers customize their homeowners insurance coverage?

First-time buyers can customize their coverage based on individual needs by opting for additional options like flood insurance, personal property endorsements, and liability protection.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-75x75.jpg)

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)