How to Compare Auto Insurance Quotes the Smart Way sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

In a world where auto insurance is a necessity, finding the best coverage at competitive rates is crucial. Understanding the nuances of comparing auto insurance quotes can save you time and money in the long run. Let's dive into the intricacies of this process and discover how to make informed decisions when it comes to your auto insurance needs.

Introduction to Auto Insurance Quotes

When it comes to auto insurance, comparing quotes is crucial to finding the best coverage at competitive rates. It allows you to make an informed decision and ensure you are getting the most value for your money.

Factors such as your driving record, location, and the type of coverage you choose can significantly impact the quotes you receive. By understanding these factors, you can tailor your insurance plan to meet your specific needs.

Factors to Consider When Comparing Quotes

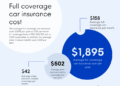

- Key factors to consider when comparing auto insurance quotes include coverage options, deductibles, and premiums.

- The type of coverage you choose, whether it's liability, comprehensive, or collision, will affect the quotes you receive. Each type offers different levels of protection.

- Personal factors such as your driving record, age, and location can also influence the cost of insurance. Insurance providers use these factors to assess your risk level.

How to Start Comparing Auto Insurance Quotes

Before comparing quotes, gather information from multiple insurance providers to ensure you have a comprehensive view of your options. Make sure to provide accurate details about your vehicle, driving history, and insurance needs.

Utilize online comparison tools to streamline the process and receive quotes quickly. These tools can help you compare rates and coverage options side by side.

Analyzing and Comparing Quotes

- Analyze the coverage limits and types offered in each quote to determine which plan best suits your needs.

- Compare deductibles, as they can impact the cost of insurance. A higher deductible typically results in lower premiums.

- Look for any additional benefits or discounts included in the quotes, as these can add value to your policy.

Understanding Policy Details

Break down the policy documents to understand the coverage terms and conditions

Be aware of any exclusions or limitations that may impact your decision. Understanding these details is essential to selecting the right insurance plan.

Making a Smart Decision

- Evaluate the overall value of each insurance quote by considering coverage, cost, and customer service.

- Customer service and claims process are vital factors to consider when choosing an insurer. A responsive and reliable insurer can provide peace of mind in case of an accident.

- Customize your coverage to fit your specific needs and budget. Consider additional coverage options or discounts that align with your requirements.

Final Summary

As we conclude our exploration of how to compare auto insurance quotes the smart way, it's evident that this task requires attention to detail and a strategic approach. By utilizing the tips and information provided, you can navigate the world of auto insurance quotes with confidence and secure the coverage that best fits your needs.

FAQ Corner

What factors can influence insurance quotes?

Insurance quotes can be influenced by various factors such as coverage options, deductibles, type of coverage, driving record, and location. These factors play a significant role in determining the cost of your auto insurance premiums.

How can I gather quotes from multiple insurance providers?

To gather quotes from multiple insurance providers, you can either visit their websites individually or use online comparison tools that aggregate quotes from different companies. This allows you to compare prices and coverage options conveniently.

Why is it important to understand policy details?

Understanding policy details is crucial to avoid surprises later on. By breaking down the policy documents and reading the fine print, you can grasp the coverage terms, exclusions, and limitations that may impact your decision.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)