Exploring the factors that impact your term life insurance premium rates can shed light on how to navigate this important financial decision. From age to lifestyle choices, every aspect plays a crucial role in determining the cost of your coverage.

Let's delve into the intricacies of premium rates and uncover what truly affects them.

Factors Affecting Term Life Insurance Premium Rates

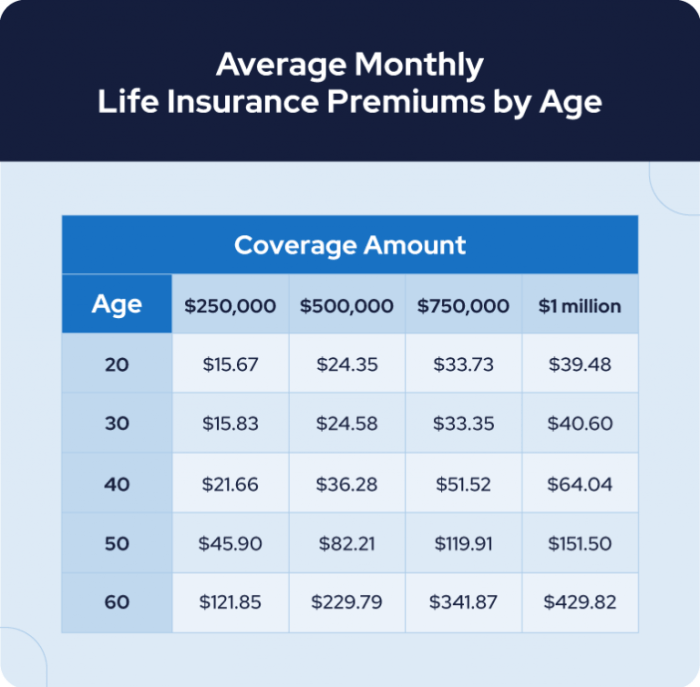

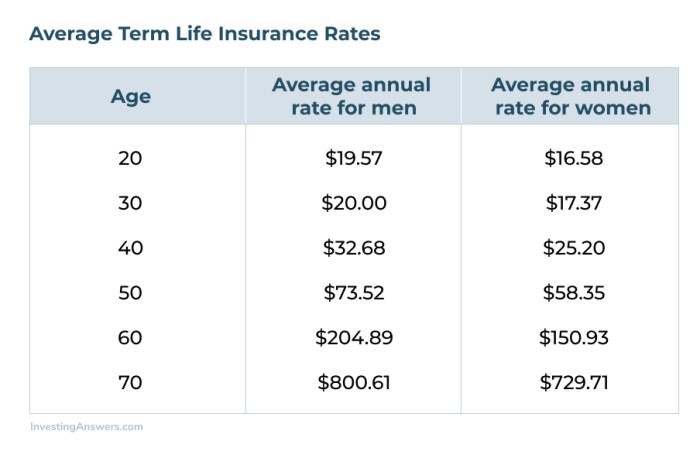

Age is a crucial factor that impacts term life insurance premium rates. Younger individuals typically pay lower premiums compared to older individuals due to the lower risk of mortality associated with younger age groups.

Role of Health and Lifestyle Choices

Health and lifestyle choices play a significant role in determining term life insurance premiums. Individuals with pre-existing medical conditions or unhealthy habits such as smoking are likely to pay higher premiums due to the increased risk of mortality associated with these factors.

Coverage Amount and Term Length

The coverage amount and term length of a term life insurance policy directly influence premium costs. Higher coverage amounts and longer term lengths often result in higher premiums to provide adequate protection for the policyholder's beneficiaries.

Smoking vs. Non-Smoking Status

Smoking status is a major factor affecting term life insurance premium rates. Smokers typically pay significantly higher premiums compared to non-smokers due to the higher risk of mortality associated with smoking. Quitting smoking can lead to lower premium rates over time as the risk decreases.

Underwriting Process for Term Life Insurance

When applying for term life insurance, the underwriting process plays a crucial role in determining your premium rates. This process involves evaluating various risk factors to assess the likelihood of a policyholder making a claim during the policy term.

Evaluating Risk Factors

During the underwriting process, insurance companies may require applicants to undergo medical exams, provide health questionnaires, or submit medical records. These assessments help insurers determine the overall health and lifestyle of the applicant, which directly impacts the risk associated with insuring them.

- Medical Exams: Applicants may be asked to undergo a medical exam to assess their current health status. This may include measurements of height, weight, blood pressure, and blood tests to check for underlying medical conditions.

- Health Questionnaires: Applicants are typically required to answer detailed questions about their medical history, lifestyle habits, and any pre-existing conditions they may have.

- Medical Records: Insurance companies may also request access to an applicant's medical records to gain a comprehensive understanding of their health history.

Impact on Premium Rates

The underwriting decisions based on the evaluation of risk factors directly influence the premium rates offered to applicants. Individuals with lower health risks are likely to receive lower premium rates, as they are considered less likely to make a claim during the policy term.

On the other hand, applicants with higher health risks may face higher premium rates to compensate for the increased likelihood of claims.

Pre-existing Conditions

Having pre-existing conditions can significantly affect both eligibility and premium rates for term life insurance. Insurance companies may consider pre-existing conditions when calculating premium rates or even deny coverage altogether based on the severity of the condition. Applicants with pre-existing conditions may need to explore specialized insurance options or consider alternatives to traditional term life insurance.

Shopping for Term Life Insurance Quotes

When looking to purchase a term life insurance policy, it is essential to shop around for quotes from various insurance providers to ensure you are getting the best coverage at the most affordable rates. Comparing quotes can help you make an informed decision based on your specific needs and budget.

Identify Reputable Sources for Obtaining Term Life Insurance Quotes

- Start by reaching out to well-known insurance companies that specialize in term life insurance.

- Utilize online insurance comparison websites that can provide quotes from multiple providers at once.

- Consider working with an independent insurance agent who can help you navigate through different options and find the best policy for you.

Compare Quotes from Different Insurance Providers

- Request quotes for the same coverage amount and term length to make an accurate comparison.

- Take note of any additional riders or features included in the policy that may affect the overall cost.

- Look beyond the premium rates and consider the financial stability and reputation of the insurance company.

Review Policy Features Besides Premium Rates

- Understand the terms and conditions of the policy, including exclusions and limitations.

- Check for any optional riders that can enhance your coverage, such as critical illness or disability benefits.

- Ensure the policy aligns with your long-term financial goals and provides adequate protection for your loved ones.

Customize a Policy to Balance Coverage and Affordability

- Consider adjusting the coverage amount and term length to fit your budget and future needs.

- Explore different payment options, such as monthly, quarterly, or annual premiums, to find what works best for you.

- Consult with an insurance professional to tailor a policy that meets your specific requirements without overpaying for unnecessary features.

Tips for Lowering Term Life Insurance Premiums

When it comes to term life insurance, there are several strategies you can implement to lower your premium rates. By focusing on improving your health, purchasing coverage at a younger age, making lifestyle changes, and adjusting your coverage or term length, you can potentially save money while still securing valuable protection for your loved ones.

Improving Health to Lower Premiums

- Regular exercise and a balanced diet can help improve your overall health, potentially leading to lower premium rates.

- Quitting smoking and reducing alcohol consumption can also have a positive impact on your premiums.

- Regular health check-ups and screenings can help detect and address any health issues early on, potentially reducing your insurance costs.

Purchasing Term Life Insurance at a Younger Age

- Purchasing term life insurance at a younger age typically results in lower premium rates, as you are considered lower risk by insurance companies.

- Locking in a lower rate early on can provide you with long-term savings over the life of your policy.

- Consider purchasing coverage when you are young and healthy to take advantage of the most affordable rates.

Lifestyle Changes for Positive Impact on Premium Rates

- Making healthy lifestyle changes such as maintaining a healthy weight, managing stress, and getting an adequate amount of sleep can positively impact your premium rates.

- Avoiding high-risk activities such as extreme sports or dangerous hobbies can also help lower your insurance costs.

- Insurance companies may offer discounts for policyholders who demonstrate a commitment to a healthy lifestyle.

Adjusting Coverage or Term Length to Reduce Premiums

- Consider adjusting your coverage amount to a level that adequately meets your needs without being excessive, as higher coverage amounts typically result in higher premiums.

- Shortening the term length of your policy can also lead to lower premiums, especially if you only need coverage for a specific period of time.

- Review your policy periodically to ensure you are not paying for coverage you no longer need, which can help reduce your premium costs.

End of Discussion

As we wrap up our discussion on what affects your term life insurance premium rates, it becomes clear that understanding these factors is key to making informed decisions about your coverage. By considering age, health, coverage amount, and other variables, you can take proactive steps to secure the right policy for your needs.

Question Bank

How does age impact term life insurance premium rates?

As you age, the risk of mortality increases, leading to higher premium rates for older individuals. Younger policyholders typically enjoy lower premiums due to their lower risk profile.

What role do lifestyle choices play in determining premium rates?

Lifestyle choices such as smoking, excessive drinking, and engaging in high-risk activities can lead to higher premium rates as they increase the likelihood of health complications. Adopting healthier habits can help lower your premiums.

How can coverage amount and term length influence premium costs?

Choosing a higher coverage amount or longer term length will result in higher premium costs, as the insurance company is taking on a greater financial risk. Opting for a lower coverage amount or shorter term can help reduce your premiums.

Does smoking status affect premium rates?

Smokers typically pay higher premiums compared to non-smokers due to the increased health risks associated with smoking. Quitting smoking can lead to significant savings on your term life insurance premiums.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)