Exploring ways to secure an auto insurance quote that aligns with your financial plans can be a daunting task. In this guide, we delve into the intricacies of finding the perfect auto insurance coverage without breaking the bank.

As we navigate through the various aspects of auto insurance quotes and coverage, you'll uncover valuable insights to make informed decisions tailored to your budget.

Researching Auto Insurance Providers

When looking for auto insurance providers, it is essential to consider various factors to ensure you find the best fit for your needs. Comparing multiple providers is crucial to get the most competitive rates and coverage options. Here are some tips on how to find reputable auto insurance companies.

Factors to Consider When Researching Auto Insurance Providers:

- Financial Stability: Check the financial strength ratings of the insurance company to ensure they can fulfill their claims obligations.

- Coverage Options: Look for a provider that offers the coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Customer Service: Read reviews and testimonials to gauge the level of customer service provided by the insurance company.

- Discounts and Rewards: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or good student discounts.

Why Comparing Multiple Auto Insurance Providers is Important:

- Cost Savings: By comparing quotes from different providers, you can find the most affordable premium rates that fit your budget.

- Coverage Options: Each insurance company offers different coverage options, so comparing them allows you to choose the one that best suits your needs.

- Policy Features: By comparing policies, you can identify additional features or benefits offered by different providers.

Tips on How to Find Reputable Auto Insurance Companies:

- Ask for Recommendations: Seek recommendations from friends, family, or colleagues who have had positive experiences with their auto insurance providers.

- Research Online: Use online resources to research customer reviews, ratings, and complaints about different insurance companies.

- Contact Insurance Agents: Speak to insurance agents to get personalized advice on the best insurance options based on your specific needs.

Understanding Auto Insurance Coverage

When it comes to auto insurance, understanding the different types of coverage available is crucial in ensuring you have the right protection for your vehicle and yourself.

Types of Auto Insurance Coverage

- Liability Coverage: This type of coverage helps pay for damages and injuries you cause to others in an accident.

- Collision Coverage: Covers repair costs for your vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-collision damages like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Steps in when the at-fault driver doesn't have insurance or enough coverage to pay for your damages.

Significance of Choosing Appropriate Coverage

Choosing the right coverage based on your individual needs is essential to ensure you are adequately protected in case of an accident. Opting for the minimum required coverage may save you money upfront, but it could leave you vulnerable to financial losses if a serious accident occurs.

Relationship between Coverage Options and Premiums

The coverage options you choose directly impact the premiums you pay for auto insurance. More comprehensive coverage typically comes with higher premiums, while opting for basic coverage can result in lower costs. It's important to strike a balance between adequate coverage and affordability to ensure you are protected without breaking the bank.

Factors Affecting Auto Insurance Quotes

When it comes to auto insurance quotes, several factors come into play that can influence the cost of your premiums. Understanding these factors can help you make informed decisions when shopping for auto insurance.

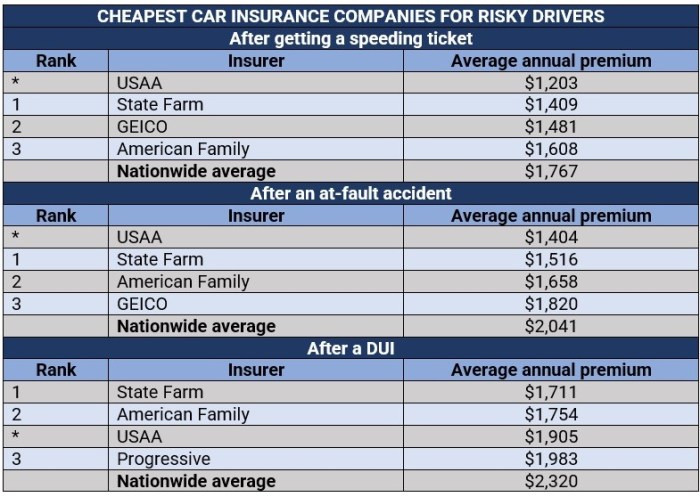

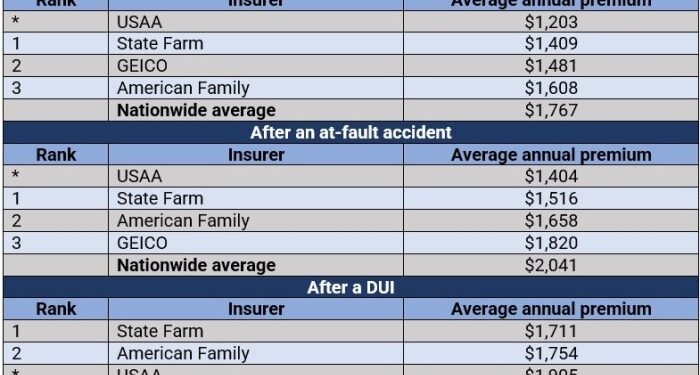

Personal Driving History

Your personal driving history is one of the key factors that insurance companies consider when determining your auto insurance quotes. If you have a history of accidents, traffic violations, or DUIs, you are considered a higher risk to insure, and as a result, your premiums are likely to be higher.

On the other hand, if you have a clean driving record with no accidents or violations, you may qualify for lower insurance rates.

- Accidents and Claims: Being involved in accidents or filing multiple claims can increase your insurance premiums.

- Traffic Violations: Tickets for speeding, reckless driving, or running red lights can also lead to higher insurance rates.

- Driving Experience: Inexperienced drivers, such as teenagers or individuals with a recently acquired license, may face higher premiums due to their lack of driving history.

Type of Vehicle

The type of vehicle you drive can also impact the cost of your auto insurance. Insurance companies take into account the make, model, and year of your car when calculating your premiums. Generally, more expensive or high-performance vehicles will cost more to insure compared to standard sedans or minivans.

- Vehicle Value: The value of your car directly affects the cost to repair or replace it in case of an accident, which influences insurance rates.

- Safety Features: Vehicles equipped with advanced safety features may qualify for discounts on insurance premiums.

- Theft Rates: Cars that are commonly targeted by thieves may have higher insurance costs to cover the risk of theft.

Obtaining and Comparing Quotes

When it comes to getting an auto insurance quote that fits your budget, one of the crucial steps is to obtain and compare quotes from different providers. This process can help you find the best coverage at the most affordable price.

Steps to Obtain Auto Insurance Quotes

- Contact Insurance Companies Directly: Reach out to insurance companies either by phone or online to request a quote.

- Work with an Insurance Agent: An insurance agent can help gather quotes from multiple providers and assist you in comparing them.

- Use Online Comparison Tools: Utilize websites that allow you to input your information once and receive quotes from various insurers.

Importance of Comparing Quotes

Comparing auto insurance quotes from different providers is essential for several reasons:

- Cost Savings: By comparing quotes, you can identify the most cost-effective option that meets your coverage needs.

- Coverage Comparison: Different providers may offer varying levels of coverage for the same price, so comparing allows you to choose the best value.

- Customer Reviews: Looking into customer reviews can give you insights into the quality of service provided by each insurer.

Tools for Effective Quote Comparison

There are several tools and websites that can help simplify the process of comparing auto insurance quotes:

- Insurance Comparison Websites: Platforms like Gabi, Compare.com, and NerdWallet allow you to compare quotes from multiple insurers in one place.

- Insurance Apps: Some insurance companies have mobile apps that make it easy to obtain and compare quotes on the go.

- Online Calculators: Use online insurance premium calculators to estimate costs based on your specific needs and circumstances.

Negotiating for Better Rates

When it comes to auto insurance, negotiating for better rates is a key strategy to ensure you get the best coverage at a price that fits your budget. By understanding how to effectively communicate with insurance providers and leverage quotes, you can increase your chances of securing a more affordable policy.

Tips for Negotiating Lower Rates

- Research the market rates: Before entering negotiations, make sure to research the average rates for auto insurance in your area. This will give you a benchmark to compare quotes and negotiate effectively.

- Highlight your driving record: If you have a clean driving record or have completed defensive driving courses, make sure to mention these to the insurance agent. This can help lower your rates as it demonstrates responsible driving habits.

- Bundle your policies: Consider bundling your auto insurance with other policies, such as home or renters insurance, to potentially qualify for a multi-policy discount.

Leveraging Quotes During Negotiations

- Use competitive quotes: When negotiating with an insurance provider, be prepared to share quotes from other companies. This can show that you are actively comparing rates and may encourage the provider to offer you a better deal.

- Ask about discounts: Inquire about any available discounts that you may qualify for, such as good student discounts, low mileage discounts, or discounts for safety features in your vehicle.

Effective Communication with Insurance Agents

- Be clear about your needs: Clearly communicate the coverage you require and any budget constraints you have to the insurance agent. This can help them tailor a policy that meets your needs while staying within your budget.

- Ask questions: Don't hesitate to ask questions about the policy details, coverage options, and potential discounts. Understanding your policy can help you negotiate more effectively.

Ultimate Conclusion

Concluding our discussion on obtaining an auto insurance quote that suits your budget, it's evident that with the right knowledge and approach, you can secure a policy that meets your needs without excessive financial strain.

Clarifying Questions

What factors should I consider when researching auto insurance providers?

When researching providers, consider factors like coverage options, customer reviews, financial stability, and available discounts.

Why is it important to compare multiple auto insurance providers?

Comparing providers allows you to find the best coverage at competitive rates, ensuring you get the most value for your money.

How can I negotiate for better auto insurance rates?

To negotiate better rates, leverage competitive quotes, highlight your driving record, and communicate effectively with insurance agents.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)