Business Insurance for LLC Startups in Competitive Markets sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In a world where risks abound and uncertainty looms large, the importance of securing adequate insurance for LLC startups cannot be overstated. As these ventures navigate through the competitive landscape, they face unique challenges that demand tailored protection. Let's delve into the realm of business insurance for LLC startups in competitive markets to unravel the strategies and safeguards essential for their success.

Importance of Business Insurance for LLC Startups

Business insurance is essential for LLC startups operating in competitive markets as it provides financial protection against various risks that could potentially threaten the business's survival.

Risks Faced by LLC Startups in Competitive Markets

- Liability Risks: LLC startups may face lawsuits from customers, competitors, or employees, which could result in costly legal expenses and settlements.

- Property Risks: Damage to business property due to natural disasters, theft, or vandalism can disrupt operations and lead to significant financial losses.

- Cyber Risks: In today's digital age, LLC startups are vulnerable to cyber-attacks that can compromise sensitive data and damage the company's reputation.

- Business Interruption: Unexpected events such as a pandemic or supply chain disruptions can cause business operations to come to a halt, resulting in lost revenue.

Protecting LLC Startups with the Right Insurance Coverage

Having the appropriate insurance coverage tailored to the specific needs of an LLC startup can help mitigate the financial impact of these risks. Insurance policies such as general liability, property insurance, cyber liability, and business interruption insurance can provide peace of mind and financial security in the face of unforeseen events.

Types of Business Insurance Suitable for LLC Startups

Starting a business as an LLC in a competitive market comes with its own set of risks and challenges. Having the right insurance coverage can help protect your startup from potential financial losses in case of unexpected events. Here are the different types of insurance options suitable for LLC startups:

General Liability Insurance

General liability insurance is essential for LLC startups as it provides coverage for third-party claims of bodily injury, property damage, and advertising injury. This type of insurance can help protect your business from legal expenses and settlements in case a customer or third party sues your company for damages.

For example, if a client slips and falls in your office and decides to sue your business for medical expenses, general liability insurance can cover the costs.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for LLC startups providing professional services. This type of insurance protects your business from claims of negligence, errors, or omissions in the services you provide. For instance, if a client claims that your advice led to financial losses for their business, professional liability insurance can cover legal fees and settlements.

Property Insurance

Property insurance is important for LLC startups that own or lease commercial space, equipment, or inventory. This type of insurance provides coverage for damage or loss of physical assets due to events like fire, theft, or natural disasters. For example, if a fire breaks out in your office and destroys your equipment and inventory, property insurance can help cover the cost of replacing or repairing the damaged items.Having a combination of general liability, professional liability, and property insurance can provide comprehensive coverage for LLC startups operating in competitive markets.

It is essential to assess the specific risks faced by your business and choose the right insurance policies to safeguard your startup's financial stability.

Factors to Consider When Choosing Business Insurance

When it comes to selecting business insurance for an LLC startup in a competitive market, there are several key factors that need to be taken into consideration. Making the right choices can help protect the company from potential risks and uncertainties, ensuring its long-term success.

Budget Allocation

- One of the primary factors to consider is the budget allocated for insurance premiums. It is essential to strike a balance between adequate coverage and affordability.

- Assess the financial capability of the startup to determine how much can be allocated towards insurance without compromising other essential expenses.

- Compare quotes from different insurance providers to find the best coverage options within the allocated budget.

Industry-Specific Risks Assessment

- Each industry comes with its own set of risks and challenges. It is crucial to identify the specific risks that the LLC startup may face in its industry.

- Consult with industry experts or insurance professionals to understand the common risks associated with the business sector.

- Select insurance policies that address the specific risks faced by the startup to ensure comprehensive coverage.

Coverage Limits and Policy Customization

- Determine the appropriate coverage limits based on the size and nature of the LLC startup's operations.

- Consider additional coverage options such as business interruption insurance, cyber liability insurance, or professional liability insurance based on the unique needs of the business.

- Customize insurance policies to align with the specific requirements of the LLC startup, ensuring that all potential risks are adequately covered.

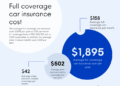

Cost-Benefit Analysis of Business Insurance for LLC Startups

Investing in business insurance for an LLC startup in a competitive market involves a cost-benefit analysis to determine the financial impact of having adequate coverage. It is essential to weigh the costs of insurance premiums against the potential benefits of protection and financial security for the business.

Analyze the Cost-Benefit of Investing in Business Insurance

- Business insurance provides protection against unexpected events such as property damage, liability claims, or lawsuits, which can result in significant financial losses for an LLC startup.

- While insurance premiums may seem like an additional expense, the cost of not having adequate coverage can far outweigh the upfront costs in the long run.

- By investing in insurance, LLC startups can mitigate financial risks and safeguard their assets, ensuring business continuity and peace of mind.

Real-World Examples of Cost Savings with Adequate Insurance

- In a scenario where a fire damages the business premises, having property insurance can cover the costs of repairs and replacements, preventing the startup from facing financial ruin.

- If an LLC startup faces a liability lawsuit from a customer injury on the premises, liability insurance can cover legal fees and settlement costs, saving the business from bankruptcy.

- Workers' compensation insurance can help cover medical expenses and lost wages for employees injured on the job, preventing financial strain on the startup.

Impact of Not Having Insurance or Being Underinsured

- Not having insurance or being underinsured can expose an LLC startup to financial risks that may lead to bankruptcy or closure.

- A single lawsuit or catastrophic event without adequate insurance coverage can wipe out the business's finances and assets, jeopardizing its survival in a competitive market.

- Underestimating the importance of insurance can result in devastating financial consequences that could have been avoided with proper risk management through insurance policies.

Ending Remarks

In conclusion, the world of business insurance for LLC startups in competitive markets is a complex yet indispensable one. By understanding the risks, exploring the available insurance options, and making informed decisions, these startups can fortify their foundations and thrive amidst competition.

As the journey continues, the shield of insurance remains a crucial ally, ensuring resilience and sustainability in the face of adversities.

Popular Questions

What specific risks do LLC startups face in competitive markets?

LLC startups in competitive markets are vulnerable to risks such as fierce competition, intellectual property disputes, and financial liabilities. Having appropriate insurance coverage can mitigate these risks and safeguard the business against unforeseen challenges.

What factors should LLC startups consider when choosing business insurance?

LLC startups should consider factors like budget constraints, industry-specific risks, coverage limits, and the reputation of the insurance provider when selecting business insurance. By evaluating these factors comprehensively, startups can ensure they have adequate protection tailored to their needs.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)