Discover the potential savings with Home and Auto Insurance Bundles in this informative piece. Learn how bundling your insurance policies can lead to significant cost reductions and explore the benefits of consolidating your coverage under one provider.

Importance of Home and Auto Insurance Bundles

When it comes to insurance, bundling your home and auto policies can offer numerous benefits beyond just convenience. Insurance bundling involves purchasing multiple insurance policies from the same provider, often resulting in cost savings and added perks.

Cost Savings

- Insurance companies typically offer discounts to customers who bundle multiple policies together. By combining your home and auto insurance, you can enjoy lower premiums compared to purchasing separate policies from different providers.

- Bundling also simplifies the billing process, as you'll receive one statement for both policies, making it easier to manage your payments and stay organized.

- Additionally, insurance companies may offer loyalty discounts to customers who have multiple policies with them, further reducing your overall costs over time.

Benefits of Same Provider

- Having both your home and auto insurance policies with the same provider can streamline the claims process in case of an incident involving both your home and vehicle. This can lead to faster resolution and less hassle for you as the policyholder.

- Furthermore, bundling can result in increased coverage limits or additional benefits that you may not have access to if you had separate policies with different providers.

- Some insurance companies may also offer a single deductible for bundled policies, meaning you'll only have to pay one deductible amount in the event of a claim that involves both your home and auto.

Factors Affecting Bundle Discounts

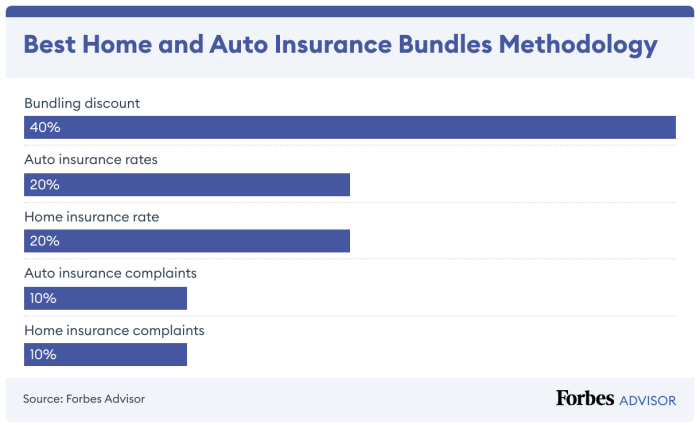

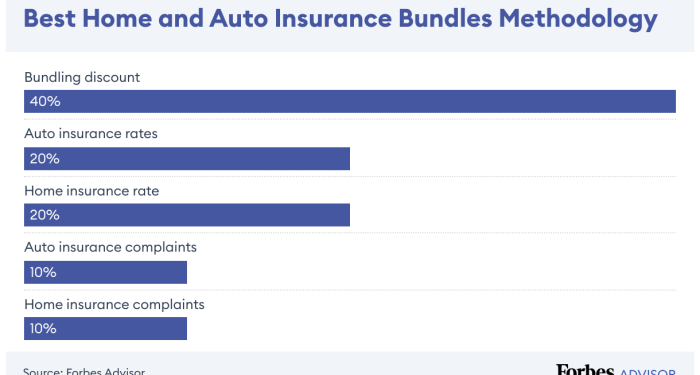

When it comes to home and auto insurance bundles, several key factors come into play to determine the cost reduction in premiums. Insurance companies play a crucial role in offering discounts based on various aspects of the policies.

Type of Policies

The type of policies included in the bundle directly impacts the discount offered. Combining a home insurance policy with an auto insurance policy from the same company often results in a lower overall premium. This is because insurance companies value customer loyalty and retention, encouraging clients to consolidate their policies with them.

Coverage Levels

The coverage levels of both the home and auto insurance policies also influence the discount provided. Insurance companies may offer a higher discount when customers opt for comprehensive coverage on both policies. This demonstrates a lower risk for the insurer as they have a more complete view of the client's coverage needs.

Multi-Policy Discount Programs

Insurance companies typically have multi-policy discount programs in place to incentivize customers to bundle their policies together. These programs are designed to reward individuals who choose to consolidate their insurance needs with one provider. By participating in these programs, customers can enjoy significant savings on their monthly premiums.

Tips for Maximizing Savings

When it comes to maximizing savings on bundled insurance, there are several strategies you can use to get the best deal and ensure you are saving the most money possible. Comparing different bundled options and reviewing policies annually are key steps in achieving this goal.

Comparing Different Bundled Options

- Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Consider the reputation and customer service of each insurance company before making a decision.

- Look for discounts or special offers that may be available when bundling home and auto insurance policies together.

Reviewing Policies Annually

- Regularly review your insurance policies to ensure you are still getting the best rate and coverage.

- Update your insurance provider on any changes in your circumstances that may affect your policy.

- Ask your insurance agent about any new discounts or promotions that may help reduce your premium.

Potential Drawbacks to Consider

When considering bundling home and auto insurance, it's important to be aware of potential drawbacks that could impact your overall savings and coverage. While bundling can often lead to cost savings, there are certain scenarios where it may not be the most cost-effective option.

Understanding these drawbacks can help you make an informed decision on whether bundling is right for you.

Inadequate Coverage for Specific Needs

One potential drawback of bundling home and auto insurance is that it may result in inadequate coverage for specific needs. For example, if you require specialized coverage for certain items in your home or have unique auto insurance needs, a bundled policy may not provide the level of coverage you need.

In such cases, keeping your policies separate and customizing each policy to meet your specific requirements might be a better option.

Higher Rates for Individual Policies

In some situations, bundling home and auto insurance may actually lead to higher rates for individual policies. This can happen if one of your insurance needs is considered high-risk, leading to an increase in premiums for both home and auto insurance when bundled together.

In such cases, it might be more cost-effective to purchase separate policies from different insurers to ensure you get the best rates for each type of coverage.

Limited Choices and Flexibility

Another drawback of bundling home and auto insurance is the limited choices and flexibility it may offer. When you bundle your policies with a single insurer, you may have fewer options when it comes to coverage levels, deductibles, and policy features.

This lack of flexibility could prevent you from tailoring your insurance to your exact needs and preferences. Keeping your policies separate allows you the freedom to choose different insurers for each policy and customize your coverage accordingly.

Conclusive Thoughts

In conclusion, bundling your home and auto insurance can be a smart financial move to lower your monthly costs. By understanding the factors influencing bundle discounts and following tips to maximize savings, you can make informed decisions about your insurance coverage.

Consider the drawbacks carefully and weigh your options to determine if bundling is the right choice for you.

Top FAQs

Is bundling home and auto insurance always cheaper?

While bundling can lead to discounts, it's essential to compare prices to ensure you're getting the best deal.

Are there any risks associated with bundling insurance policies?

One potential drawback is that you may miss out on better deals from other providers if you only focus on bundling.

Can I customize my coverage when bundling home and auto insurance?

Yes, you can typically tailor your coverage to fit your specific needs even when bundling policies.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)