Exploring the nuances between Term Life Insurance Quotes and Permanent Coverage, this introduction sets the stage for an informative and engaging discussion that delves into the key differences and considerations of each type of insurance.

As we navigate through the intricacies of term life insurance and permanent coverage, readers will gain a deeper understanding of the various factors that come into play when choosing the right insurance policy.

Term Life Insurance Quotes

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. If the policyholder passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

However, if the policyholder outlives the term, no payout is made.

How Term Life Insurance Works

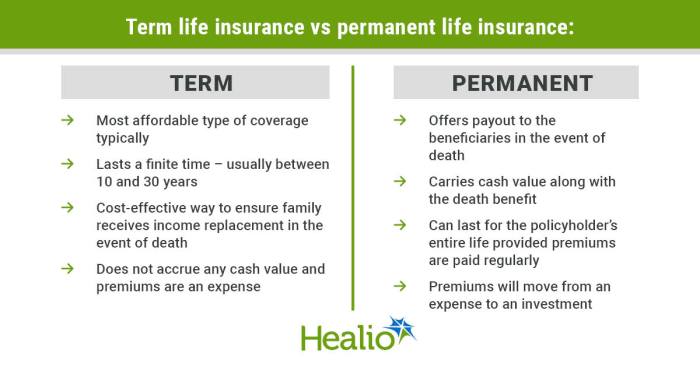

Term life insurance works by offering coverage for a set period of time, providing financial protection for your loved ones in the event of your death. Premiums are typically lower compared to permanent life insurance policies, making term life insurance an affordable option for many individuals.

Typical Coverage Lengths

Term life insurance coverage lengths can vary, but common terms include 10, 20, and 30 years. Policyholders can choose the term that aligns with their financial obligations, such as mortgage payments or college tuition for children.

Cost Comparison with Permanent Coverage

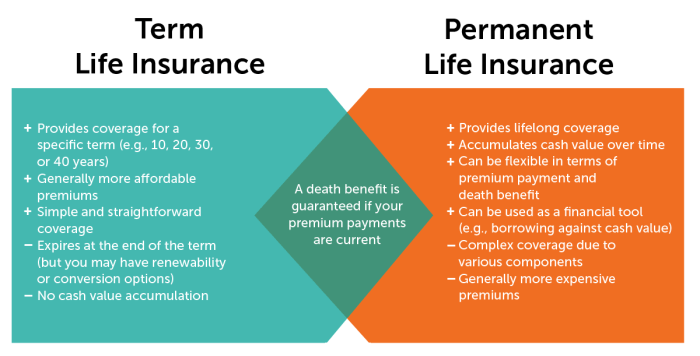

Term life insurance is generally more affordable than permanent coverage, such as whole life or universal life insurance. The premiums for term life insurance are fixed for the duration of the term, while permanent coverage can be significantly more expensive due to the cash value component and lifelong coverage.

Benefits and Limitations

The benefits of term life insurance include affordability, flexibility in choosing coverage lengths, and simplicity in terms of policy structure. However, term life insurance has limitations, such as no cash value accumulation and the potential for coverage to expire before the policyholder's death, leaving loved ones unprotected.

Permanent Coverage

Permanent life insurance provides coverage for the insured's entire lifetime, as long as premiums are paid. Unlike term life insurance, which only covers a specific period, permanent coverage offers lifelong protection.

Types of Permanent Life Insurance Policies

- Whole Life Insurance: Offers a guaranteed death benefit, fixed premium payments, and a cash value component that grows over time.

- Universal Life Insurance: Provides flexibility in premium payments and death benefits, along with the potential to adjust coverage and cash value accumulation.

- Variable Life Insurance: Allows the policyholder to invest the cash value in various investment options, offering the potential for higher returns but also higher risks.

When Permanent Coverage is More Suitable

Permanent coverage may be more suitable in scenarios where long-term financial protection is needed, such as:

- Providing for dependents who will require financial support even after the term policy expires.

- Estate planning to cover estate taxes or leave an inheritance for heirs.

- Building cash value that can be accessed during the insured's lifetime for financial needs or retirement income.

Cash Value Component of Permanent Life Insurance

Permanent life insurance policies include a cash value component, which is a savings or investment account within the policy. This cash value grows tax-deferred over time, based on the policy's performance and contributions. Policyholders can access this cash value through loans or withdrawals, providing a source of funds for various financial needs.

Final Conclusion

In conclusion, understanding the distinctions between term life insurance and permanent coverage is crucial in making an informed decision about your insurance needs. Whether you opt for the flexibility of term life insurance or the long-term benefits of permanent coverage, being aware of the pros and cons of each type will empower you to secure the right protection for yourself and your loved ones.

FAQ Overview

What is the main difference between term life insurance and permanent coverage?

The main difference lies in the duration of coverage - term life insurance provides coverage for a specific period, while permanent coverage lasts a lifetime.

Are term life insurance premiums typically lower than permanent coverage?

Yes, term life insurance premiums are usually more affordable compared to permanent coverage, making it a popular choice for those seeking cost-effective protection.

Do permanent life insurance policies have a cash value component?

Yes, permanent life insurance policies accumulate cash value over time, which can be accessed by the policyholder during their lifetime.

![High Value Home Insurance: The Ultimate Buyer’s Guide [Free Resource]](https://business.haijakarta.id/wp-content/uploads/2025/12/hh-2-980x980-1-120x86.jpg)